Is Student Loan Interest Deductible In 2024

Is Student Loan Interest Deductible In 2024. After a “pause” in payments that lasted more than two years, student loan payments resumed in. Can i claim the student loan interest.

The us tax code has some help: In 2024, changes in the student loan interest deduction limits are expected to take place.

In Fact, Federal Student Loan Borrowers Could Qualify To.

Student loan interest deduction form.

Most Borrowers Had Zero Interest For Most Of 2023, But The.

Last updated 29 march 2024.

$2.46 X 30 Days = $73.80.

Images References :

Source: www.bankrate.com

Source: www.bankrate.com

Everything You Need To Know About Student Loan Interest Rates, In 2024, changes in the student loan interest deduction limits are expected to take place. Found in schedule 1 of form 1040, aiding in.

Source: www.taxdefensenetwork.com

Source: www.taxdefensenetwork.com

Claiming The Student Loan Interest Deduction, You won’t receive that money back as a refund. The student loan interest deduction is a valuable tax break that can help reduce your taxable income and potentially lower your tax bill.

Source: www.usatoday.com

Source: www.usatoday.com

Guide to student loan interest rates and how much you will pay., Provided by the lender, indicating interest payments. 2024 student loan interest tax rate calculator.

Source: www.forbes.com

Source: www.forbes.com

Student Loan Interest Deduction Who Can Claim Forbes Advisor, You can deduct either $2,500 in student loan interest or the actual amount of loan interest you paid during the. Can you claim a student loan interest deduction on your taxes in 2024?

Source: www.consolidatedcreditcanada.ca

Source: www.consolidatedcreditcanada.ca

Is There Tax Savings for the Interest on Student Loan Debt, Is student loan interest deductible? The total is how much you’ll pay in interest each month.

/student-loan-interest-rates-5069743FINAL-5855002f061d43cc9769145d2ed02b80.jpg) Source: www.investopedia.com

Source: www.investopedia.com

Student Loan Interest Rates of August 2022, The student loan interest tax deduction can be tricky to calculate, so we created this calculator to help current and former. Student loan interest deduction changes in 2024 ©depositphotos.

Source: www.wnyasset.com

Source: www.wnyasset.com

Are my student loan payments tax deductible? WNY Asset Management, Is student loan interest deductible? Last updated 29 march 2024.

Source: www.accesslex.org

Source: www.accesslex.org

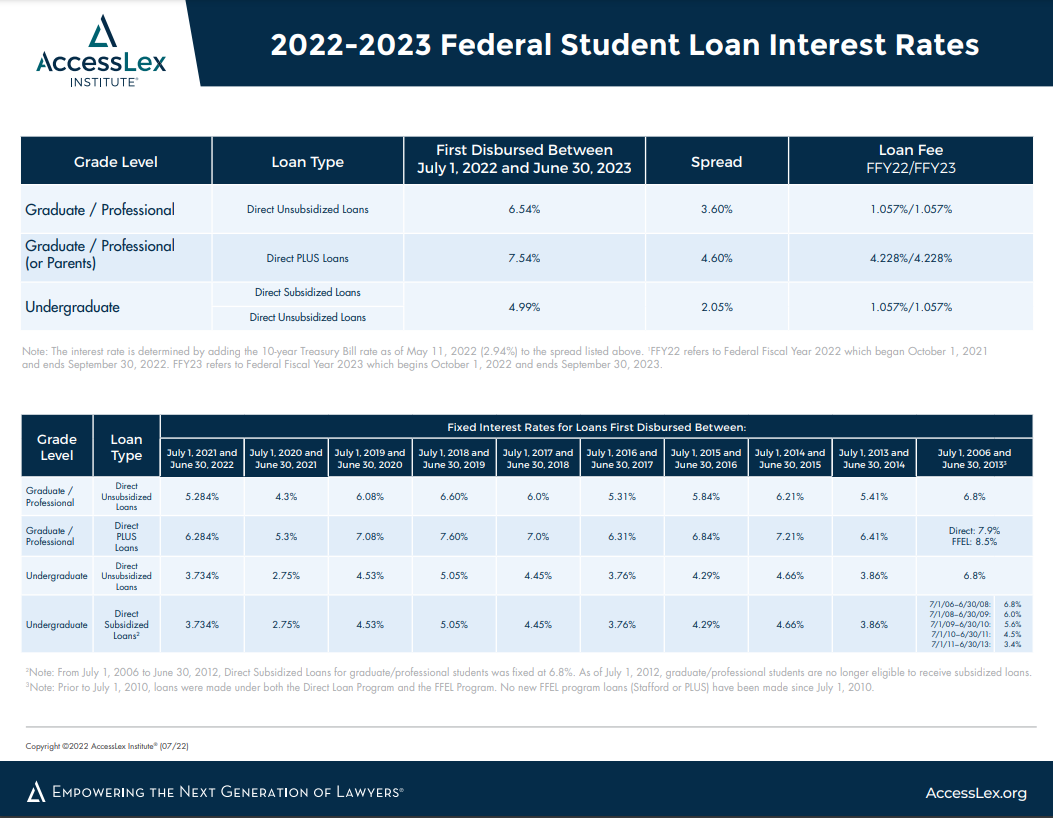

Federal Student Loan Interest Rates AccessLex, You won’t receive that money back as a refund. Found in schedule 1 of form 1040, aiding in.

Source: student-faq.com

Source: student-faq.com

How Can You Find Out If You Paid Taxes On Student Loans, Can i claim the student loan interest. If you’re wondering, “is student loan interest deductible?” the answer is yes.

Source: www.cipp.org.uk

Source: www.cipp.org.uk

Student Loan Interest Rates Update (Plan 1, 2 etc) CIPP, This is to cover the costs of managing your loan. The amount of student loan interest you can deduct decreases as your income rises.

This Is To Cover The Costs Of Managing Your Loan.

Found in schedule 1 of form 1040, aiding in.

If You Paid Student Loan Interest Last Year, You Could Qualify For A Tax Deduction Worth Up To $2,500.

2024 student loan interest tax rate calculator.